Here’s the translation to American English:

—

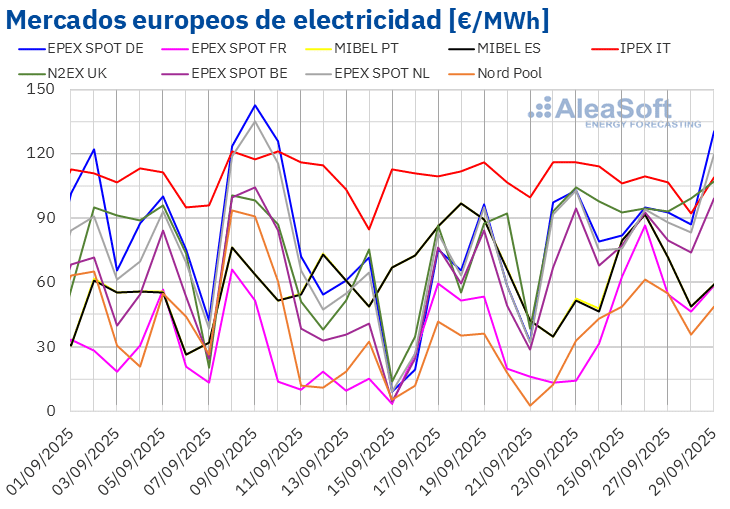

In the fourth week of September, European electricity markets have seen a notable increase in prices, coinciding with the arrival of autumn and growing demand due to cooler temperatures. This phenomenon has occurred in a context where solar energy production has significantly decreased, particularly in countries like Germany, Italy, and France.

During the week of September 22, data indicates that photovoltaic solar energy production has considerably declined, reversing the positive trend observed in previous weeks. In Germany, the drop was 34%, followed by Italy and France, where production decreased by 27% and 26%, respectively. Although the reduction was less severe on the Iberian Peninsula, Spain and Portugal reported declines of 7.5% and 4.3%.

However, there are signs of a possible recovery in solar production in Italy and Germany for the week of September 29. In contrast, Spain is expected to face another decline in this sector. Wind production on the Iberian Peninsula, on the other hand, has shown significant growth, with an increase of 52% in Portugal and 16% in Spain. On September 28, Portugal reached its highest wind production since April 2025, totalling 74 GWh.

In various European markets, wind production has been declining, with drops of 35% in Germany, 29% in France, and 4.6% in Italy. In terms of demand, most European electricity markets have experienced an increase, with the UK and France leading the way with rises of 5.6% and 5.3%, respectively. However, in Southern Europe, declines have been observed, with Spain reducing its electricity demand by 11%.

Average temperatures have fallen across several markets, with drops ranging from 3.2°C in Italy to 6.4°C in France. For the last week of September, a decrease in demand is expected in most markets, except in the UK, where an increase is anticipated.

Electricity prices have generally risen in most markets, except in Italy, which saw a slight decline of 0.9%, and in MIBEL, where an 18% drop was reported. The Nord Pool market, however, has had the highest percentage increase, reaching 92%. This trend is also reflected in the Brent crude oil futures market, which experienced a significant rise, climbing from $66.57/bbl on September 22 to $70.13/bbl on September 26, driven by supply concerns due to international conflicts.

As for the TTF gas market, it has remained below €33/MWh thanks to abundant supply. European reserves exceed 80%, and CO2 emission rights prices remain above €76/t, albeit with some fluctuations.

In light of this changing landscape in the European energy sector, AleaSoft Energy Forecasting is preparing to offer a webinar that will address market outlooks for the upcoming winter season, as well as aspects related to financing renewable energy projects and storage.

—

If you need any further adjustments or details, feel free to ask!

via: MiMub in Spanish