Sure! Here’s the translation into American English:

—

The London Stock Exchange Group (LSEG) has announced the launch of an innovative solution aimed at enhancing its market surveillance capabilities by integrating artificial intelligence through Amazon Bedrock, a managed service that provides high-performance AI models. This initiative seeks to address the growing challenges in overseeing a highly complex and dynamic financial environment.

In a context where investment strategies are increasingly sophisticated, regulators demand more effective monitoring. Despite LSEG processing transactions exceeding one trillion pounds annually among 400 members, its current systems often prove outdated and generate a significant number of alerts that tend to be false positives. This situation consumes excessive time and resources, making it difficult for analysts to focus on truly significant cases.

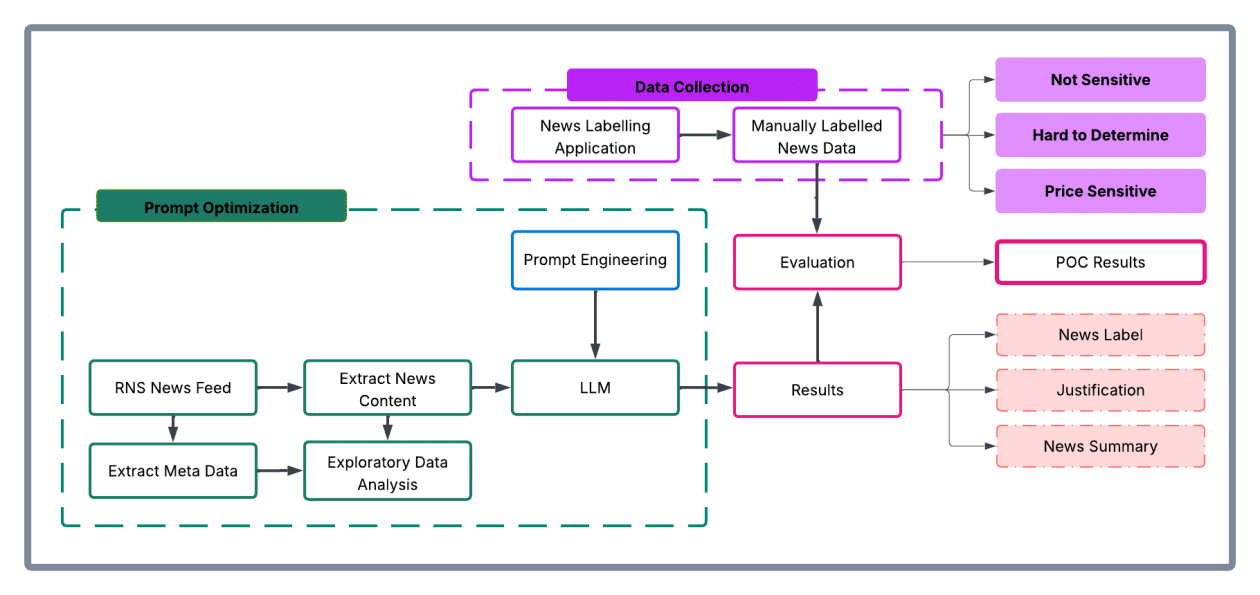

To tackle this problem, LSEG has developed the “Surveillance Guide,” an AI-based tool that automates the analysis of news and its impact on market behavior. This system is capable of identifying and assessing the sensitivity of news, facilitating a more agile and effective analysis of transactions that could imply market abuse.

The new analysis methodology categorizes news articles based on their likelihood of significantly affecting prices. By utilizing Anthropic’s Claude Sonnet 3.5 model, LSEG’s system performs detailed assessments, gathering relevant data and providing justified classifications. This not only improves the accuracy of detecting price-sensitive content but also offers detailed explanations for the classification decisions.

In a six-week trial period, the tool achieved 100% accuracy in identifying non-sensitive news and a 100% recovery rate in detecting price-sensitive content. These results enable LSEG to reduce manual review time, increase consistency in sensitivity evaluations, and enhance responsiveness to potentially abusive activities in the market.

With the ongoing evolution of market structures, the integration of artificial intelligence solutions like the one implemented by LSEG marks a significant step toward creating more robust and effective mechanisms for financial oversight. In the near future, LSEG plans to expand this solution by integrating more data sources and making adjustments to continually refine the accuracy and effectiveness of its monitoring operation.

—

Let me know if you need any changes!

Source: MiMub in Spanish