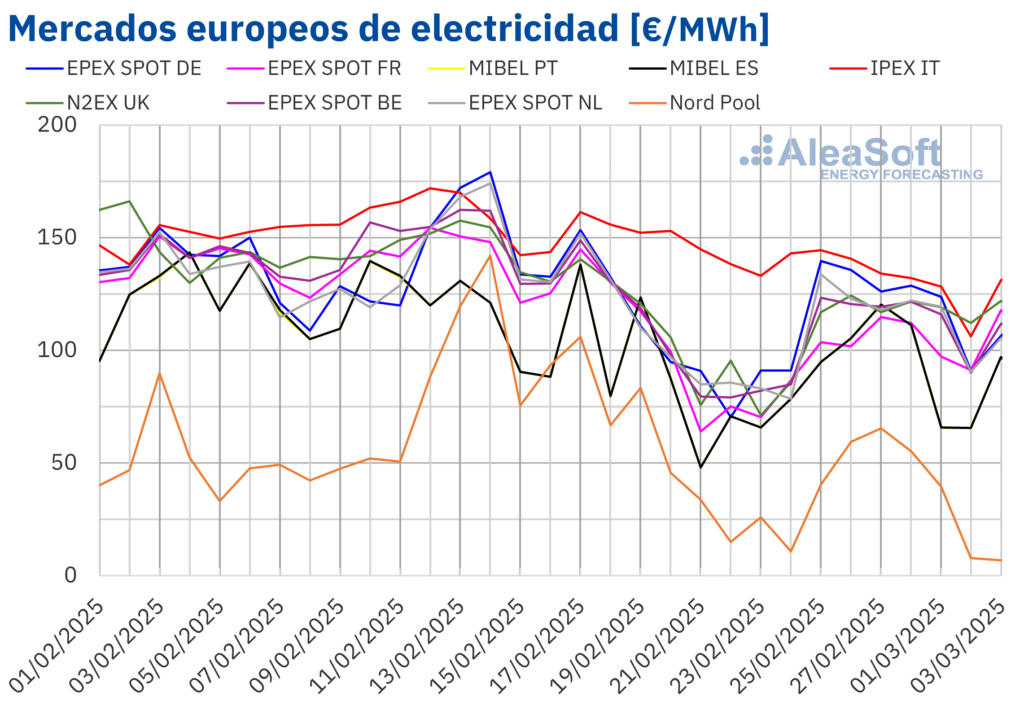

In the last week of February, European electricity markets remained above €100/MWh, with most markets experiencing increases compared to the previous week, although these increases did not exceed 12%. Spain, Portugal, and France stood out for reaching records in solar photovoltaic production, especially on February 26, when Spain generated 134 GWh and Portugal 20 GWh with this energy source. Likewise, wind production showed an increase in multiple markets, except for Germany, where a 38% decrease was recorded.

During that week, solar photovoltaic production in Portugal and France grew by 9.5% and 26% respectively. In contrast, in Italy, Spain, and Germany, production decreased, with Germany experiencing a drop of up to 29%. However, Italy saw a notable recovery in its wind production, with a 240% increase after three weeks of declines.

In terms of electricity demand, most European markets showed a decrease. Belgium and Germany were the most affected, with declines of 5.4% and 3.5%, respectively, while France had a smaller reduction of 0.7%. In contrast, Spain and the Netherlands experienced increases in demand of 1.3% and 6.9%, respectively. The milder temperatures in countries like Belgium, Italy, and Germany were identified as a factor that favored the decrease in demand.

Price analysis reveals that, despite the significant production drop in certain markets, prices experienced a general increase. However, the decrease in gas prices and CO2 emission rights helped limit these increases. The week of February 24 showed a price increase in most markets, except for the IPEX in Italy and the Nord Pool in the Nordic countries, where prices decreased by 11% and 26%, respectively.

For the first week of March, an increase in solar production in Germany and Spain is anticipated, while a continued decline is expected in Italy. Forecasts also suggest a possible increase in electricity demand in the Netherlands, Germany, and Spain, although a decrease is expected in Belgium, Italy, Great Britain, France, and Portugal.

In the realm of fuels, Brent oil futures showed a downward trend in the fourth week of February, closing at $73.18/bbl, representing a 1.7% decrease from the previous week. TTF gas futures reached their weekly low at €41.34/MWh, while CO2 emission rights prices closed at €71.00/t, marking a 3.9% decrease in the same week.

Finally, a new AleaSoft Energy Forecasting webinar is scheduled for March 13, addressing the outlook for European energy markets, energy storage, and renewable energy project financing, offering a detailed analysis of the main challenges and opportunities facing the energy sector in 2025.

Referrer: MiMub in Spanish