In an unprecedented move, the US Department of the Treasury and the Department of Homeland Security (DHS) have reached an agreement that will allow the Internal Revenue Service (IRS) to share information about taxpayers, including certain immigrants, with the Immigration and Customs Enforcement (ICE). This agreement, formalized in a 15-page memorandum of understanding (MOU), was disclosed in the context of a legal case and raises serious concerns about data privacy and immigrants’ rights in the country.

The purpose of the agreement, according to explanations from the DHS, is to prevent the unauthorized disclosure of tax information that could be used in immigration law enforcement. However, using essential government tax data in surveillance and law enforcement operations is considered an affront in a democratic society, generating distrust among those who are required to fulfill their tax obligations.

The DHS justified the agreement through Executive Order 14161, issued on January 20, 2025, which orders the identification and deportation of individuals who are in the country illegally. The memorandum states that the DHS has identified multiple individuals under criminal investigation for federal law violations, especially those related to not leaving the country. Based on these allegations, the IRS may disclose tax information that would otherwise be protected by the Tax Code.

The data exchange protocol establishes that ICE may request specific information about an individual’s name and address, relevant tax periods, and the federal laws being investigated. After receiving these requests, the IRS will evaluate them to determine if the disclosure of information conforms to the legal exceptions that allow the disclosure of confidential data.

However, this new approach has sparked criticism. A report from the NYU Tax Law Center suggests that, despite the official reason of criminal investigations, there are indications that the DHS expects to use this information to deport up to seven million people, a much higher number than could be considered the subject of legitimate investigations. This indicates that the true motive behind accessing tax information may be the location of individuals for civil deportations, masking such actions under the guise of criminal investigations.

Additionally, the reliability of ICE requests is questionable, as the agency has been accused of basing its operations on incorrect information. Recent cases have shown arrests of American citizens, reinforcing fears about the potential abuse of this new policy.

The implementation of the MOU has led to the resignation of several senior IRS officials, in a context where the agency had prioritized tax collection and the protection of taxpayer privacy. This new policy could undermine immigrants’ trust in the tax system, forcing them to choose between complying with their tax obligations or risking deportation.

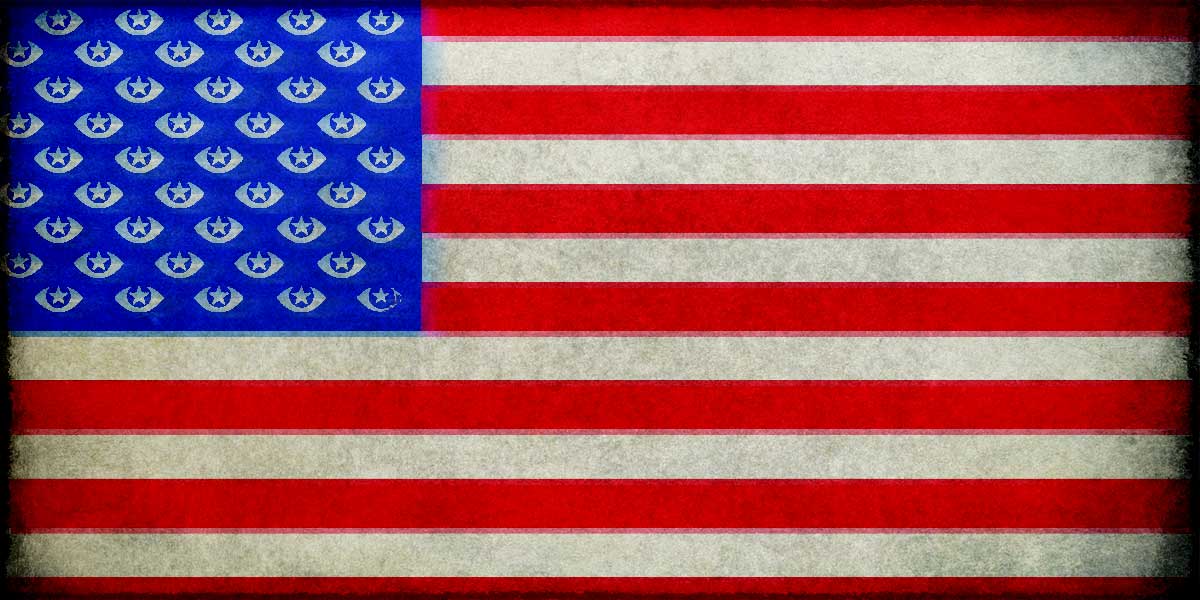

The federal government’s decision to implement this agreement not only raises concerns about data privacy and public trust, but also evokes lessons from US history, where crisis-driven policies have resulted in abuses of power. This agreement adds to growing alarm about the misuse of data in the public sector, becoming a surveillance tool in a context where the balance of power between the government and the citizen already faces significant challenges.

Referrer: MiMub in Spanish