Sure! Here’s the translation into American English:

—

The problem of fraud remains a major economic concern globally. In the United States, consumers faced losses amounting to $12.5 billion in 2024, marking an alarming 25% increase from the previous year, according to figures from the Federal Trade Commission. This increase is not due to a higher frequency of attacks but rather to the growing sophistication of scammers who employ more complex and coordinated tactics.

As fraudulent activities become more intricate, traditional machine learning approaches have proven insufficient. These methods analyze transactions in isolation, preventing the identification of patterns in networks of coordinated activities that characterize modern fraud schemes.

Graph neural networks (GNNs) have emerged as an effective solution to this challenge. These technologies model the relationships between various entities, such as users sharing devices, locations, or payment methods. Due to their ability to analyze both network structures and the attributes of entities, GNNs can detect fraud schemes that, although hidden in individual activities, leave traces in the relational networks of perpetrators.

However, implementing online fraud prevention systems based on GNNs presents several challenges. It is essential to achieve inference responses in under a second, scale to billions of nodes, and maintain operational efficiency during model updates. To address these difficulties, GraphStorm has been developed, with version 0.5 introducing real-time inference capabilities.

Unlike previous solutions that required trade-offs between capacity and simplicity, GraphStorm allows for distributed training and provides high-level APIs, making it easier to develop large-scale GNNs. This methodology includes a business training model and offline inference capabilities, but most critically, it has the ability to prevent economic losses by detecting fraud before it occurs.

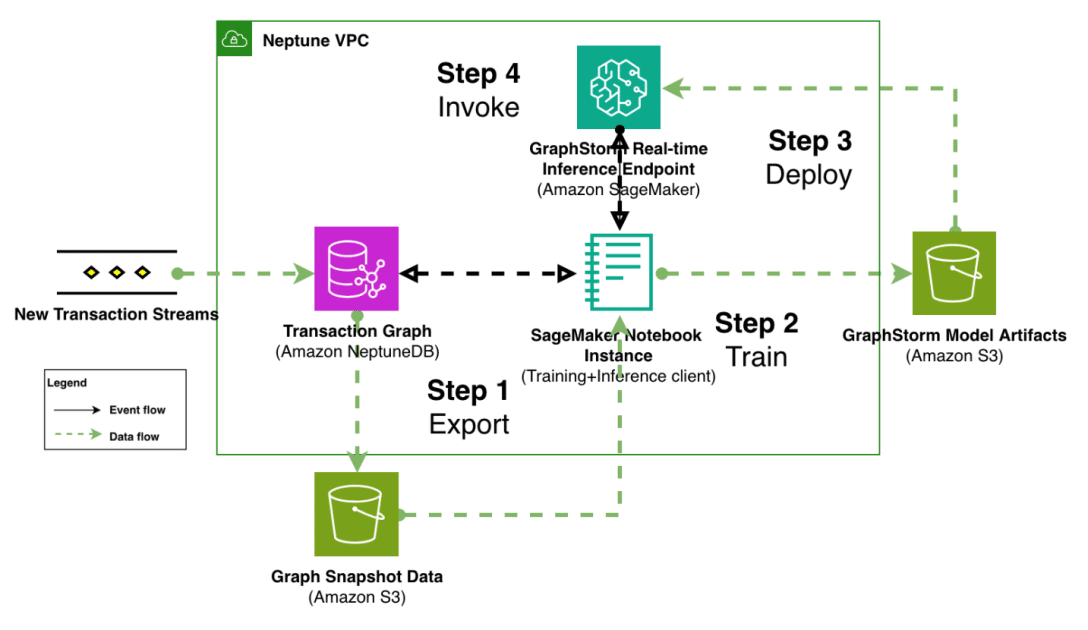

GraphStorm 0.5 proposes a four-step process that begins with exporting the transaction graph from an OLTP database to scalable storage, followed by model training, deployment simplification, and integration of client applications to process live transaction streams. This methodology not only enables data scientists to create production-ready GNN models but also optimizes operational load.

Finally, using datasets like the IEEE-CIS, which includes 500,000 anonymized transactions, provides GNNs with the necessary information to detect fraud patterns through the relationships between entities. As organizations increasingly seek to combat more sophisticated fraud threats, the adoption of GNN-based models presents a viable and effective solution for preventing this phenomenon.

Referrer: MiMub in Spanish