Here’s the translation into American English:

—

The mortgage granting process has traditionally been a complex procedure filled with paperwork, where accuracy, efficiency, and regulatory compliance are essential. However, operations in this field often rely on manual reviews and rule-based automation, which leads to delays and errors, resulting in a frustrating experience for customers. Recent surveys reveal that only about half of borrowers are satisfied with the mortgage process, with traditional banks showing greater deficiencies compared to non-bank lenders.

Customer dissatisfaction largely stems from the manual, error-prone nature of conventional processing. Delays, inconsistencies, and disjointed workflows create frustration among borrowers, negatively affecting their overall experience.

In the face of these inefficiencies, an innovative solution emerges: automatic mortgage approval using artificial intelligence. This approach leverages Amazon Bedrock technology, specifically Amazon Bedrock Agents and data automation. These agents optimize the mortgage approval process through intelligent document verification, risk assessment, and data-driven decision-making with minimal human intervention. By automating complex workflows, institutions can expedite approvals, minimize errors, and provide greater consistency, which also helps ensure regulatory compliance.

The transformation through Intelligent Document Processing (IDP) redefines how document workflows are managed, increasing efficiency and autonomy. This technology enables the automation of tasks with high precision, facilitating the extraction, classification, and processing of information, as well as identifying and correcting errors in real-time. IDP is capable of understanding the context and intent behind documents, providing valuable insights for more informed decision-making.

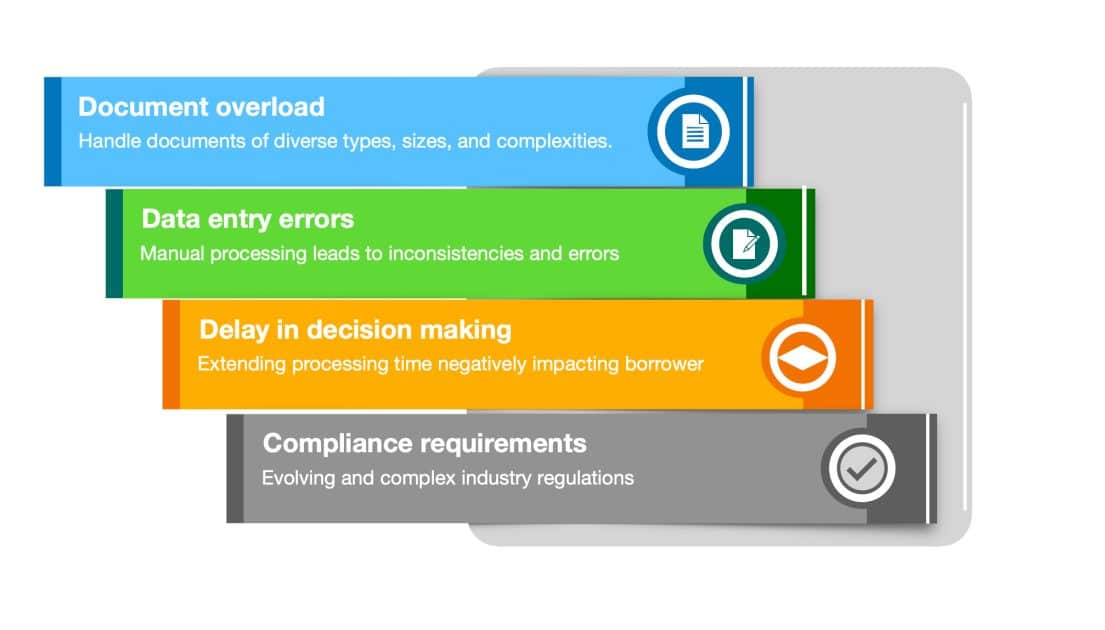

Despite the benefits IDP offers, its implementation in the mortgage context presents challenges, such as document overload and data entry errors. Reviewing a large number of documents requires significant time and resources. However, automation promises a drastic improvement in efficiency, speed, and accuracy, benefiting both lenders and borrowers.

The proposed new workflow allows the applicant to primarily interact with a supervising agent, responsible for document submission and application status verification. This agent orchestrates the process, managing sub-agents that carry out specific tasks, from initial verification to final approval. The data extraction agent, for instance, utilizes Amazon’s automation power to efficiently collect and structure information.

These advances in automated architecture for mortgage processing not only enhance efficiency and reduce errors but also speed up response times. This provides users with a quicker and more satisfying credit experience. The solution highlights the collaboration between intelligent agents and human professionals, showing how automation can optimize both workflow and customer service in a traditionally slow-moving sector.

Adopting this innovative solution presents a significant opportunity for financial organizations, which can apply automation not only in mortgage processing but also in other complex scenarios that require efficient document handling. This reduction in manual effort and acceleration of decision-making will enable institutions to deliver a customer experience that aligns with the industry’s most modern standards.

Referrer: MiMub in Spanish