Here’s the translation to American English:

—

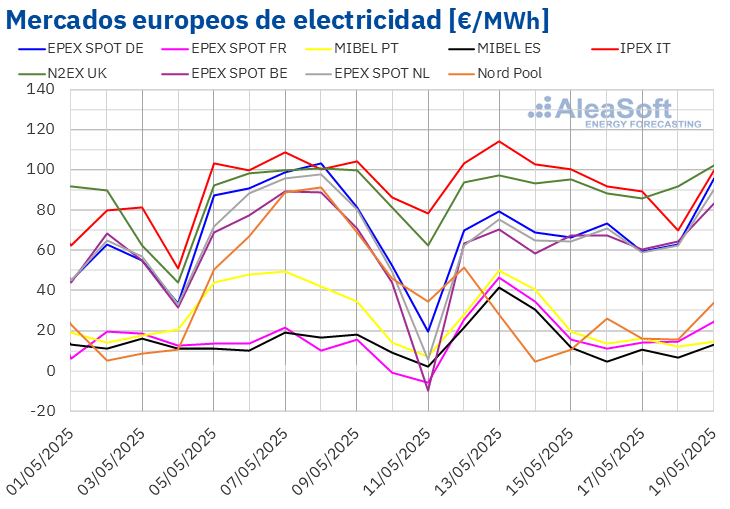

In the third week of May, European electricity markets showed diverse trends, with most registering weekly prices lower than the previous week. This behavior occurred despite rising prices for gas and carbon dioxide (CO2), as a significant increase in renewable energy production and a decrease in demand managed to stabilize, and even reduce, prices in several countries.

Portugal stood out by reaching a new historical record for daily photovoltaic production, while Germany and Italy also set notable figures, recording their highest solar production for a day in May. During the week starting May 12, solar production in these markets grew significantly; France and Italy led this increase with rises of 19% and 18% respectively. Spain and Portugal also showed monthly increases of 9.2% and 13%, although Germany, with a growth of 7.1%, showed the smallest increase.

On May 13, Germany marked a new daily record for solar production with 424 GWh, achieving the second highest value in its history. France also performed well, recording its May highs on the 14th and 16th, while on May 15, Portugal set a record of 26 GWh for solar production.

On the other hand, wind production presented varied results. While Germany, Portugal, and Italy experienced increases, Spain and France saw significant drops of 29% and 45% respectively. Despite this outlook, forecasts suggest an increase in wind production for the week of May 19.

Overall electricity demand showed a decline in most European markets. Great Britain recorded the largest drop at 3.7%, followed by Germany and Italy, which saw decreases of 1.3% and 1.2%. In contrast, Portugal and France experienced increases in their demand, influenced by higher average temperatures across Europe, and the celebration of San Isidro Day in Spain also contributed to this reduction.

Regarding electricity prices, the situation was mixed. The Spanish MIBEL and French EPEX SPOT markets experienced the largest increases, of 47% and 140% respectively, while in the Nordic countries, the Nord Pool market suffered significant declines, reaching a drop of up to 66%.

Brent crude oil prices have remained around $65/bbl this week, affected by trade relations between China and the United States and tensions in Iran. TTF gas, on the other hand, settled above €35/MWh, although it has also experienced fluctuations.

Finally, the Portuguese government has adjusted its electricity import capacity from Spain, improving the mutual understanding between both markets, although not reaching the levels prior to the blackout on April 28. As forecasts for the fourth week of May approach, an increase in prices is expected in most major European electricity markets, although MIBEL is anticipated to benefit from higher renewable energy production in the Iberian Peninsula.

—

Source: MiMub in Spanish