Sure! Here’s the translation into American English:

—

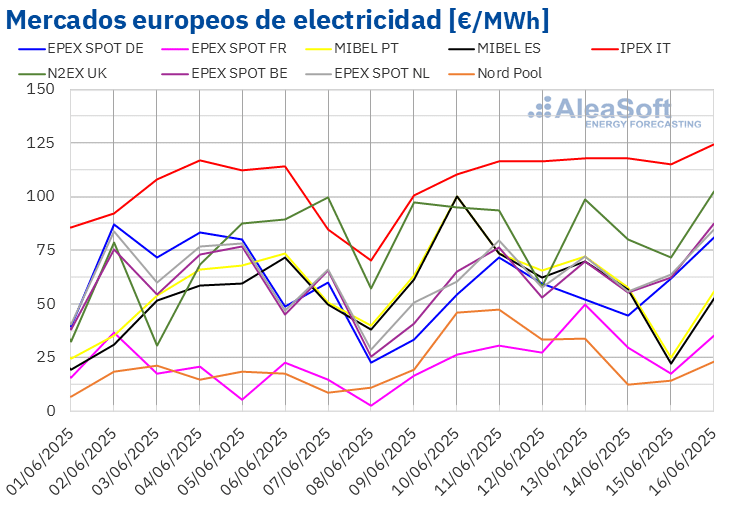

In the second week of June, the weekly prices in most European electricity markets exceeded €50/MWh, showing a notable increase compared to the previous week. Despite this rise, negative prices were reported during several hours in numerous markets, indicating persistent volatility. On June 13, futures for gas, CO2, and Brent reached their highest levels since April, highlighting the tensions that currently characterize the European energy market.

Solar photovoltaic production played a significant role, with Germany reporting a 41% increase compared to the previous period, while France saw a 38% rise. In contrast, Italy and Spain experienced more modest growths of 6.1% and 1.2%, respectively. Portugal, however, continued its downward trend, experiencing an 8.7% decline in production. France and Italy set historical records for June, achieving productions of 134 GWh and 152 GWh, with Germany breaking its own record by generating 445 GWh on June 13.

Electricity demand also showed a considerable increase, led by Italy with a 12% rise, driven by a post-holiday recovery. France and Spain recorded increases of 2.2% and 5.2%, respectively. However, Belgium, Portugal, and Germany saw their electricity demand decrease, influenced by their respective holidays.

Average temperatures in the analyzed markets increased, with Belgium, Great Britain, and France reporting significant rises. For the third week of June, an increase in demand is expected in most markets, except in Great Britain, where a decline is anticipated.

Regarding prices, while most European electricity markets showed increases, the Dutch and German markets remained stable. France and the Nordic countries experienced the most significant rises, with increases of 65% and 88%, respectively. An example of price variability is the Nordic market, which on June 14 recorded its lowest average at €12.13/MWh, while in Italy, prices exceeded €100/MWh throughout the week.

Wind production, which reversed its trend during the week, saw Spain increase its output by 12%, although France, Germany, and Portugal suffered significant declines. It is expected that for the week of June 16, wind generation will decrease widely.

Regarding Brent oil futures, prices closed higher, reaching $74.23/bbl on June 13, representing a 7% increase compared to the previous day, driven by geopolitical tensions in the Middle East. Likewise, TTF gas futures rose to €37.89/MWh, and CO2 emission rights also reached a maximum close of €75.94/t.

This situation in the markets reinforces the complex interplay of climatic factors, seasonal demands, and geopolitical tensions that continue to affect the energy dynamics in Europe.

—

Let me know if you need any adjustments!

via: MiMub in Spanish