Sure! Here’s the translation to American English:

—

Fraud detection has become a critical challenge in the financial industry, where technological innovation is essential to address increasingly sophisticated and ever-evolving fraudulent patterns. In this context, machine learning has proven to be a valuable tool, although traditional models face serious limitations related to data privacy and information security.

In 2023, the economic impact of fraud on businesses surpassed $485.6 billion, creating considerable pressure on financial institutions to adapt to new threats. Many of these organizations use isolated models that often lead to overfitting and generate inadequate performance in real-world situations. Data privacy regulations, such as GDPR and CCPA, further complicate collaboration among entities, restricting the ability to share sensitive information.

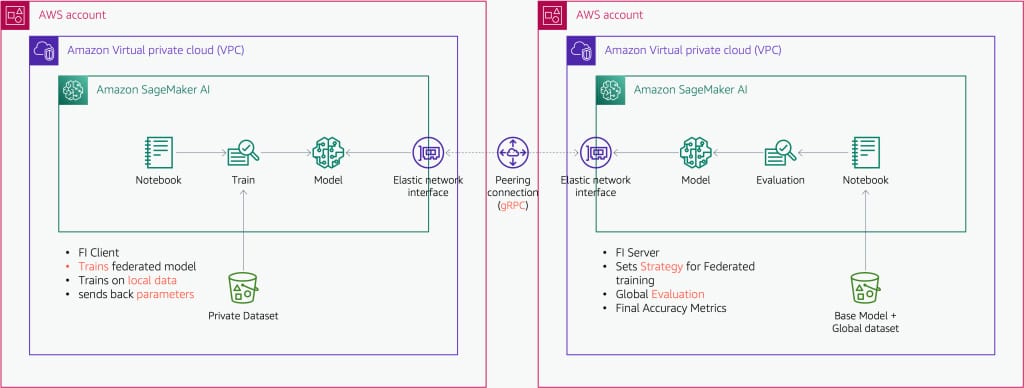

In light of this landscape, federated learning has emerged as an effective solution. This approach allows multiple organizations to collaborate on training joint models while preserving data decentralization. The use of technologies like Amazon SageMaker AI facilitates this process, enhancing the accuracy of fraud detection while complying with privacy regulations.

Federated learning not only focuses on improving model effectiveness but also addresses the concerning issue of overfitting, providing financial institutions with the capability to collaborate without jeopardizing information privacy. One of the most prominent frameworks for implementing this methodology is Flower, which seamlessly integrates with various machine learning tools such as PyTorch and TensorFlow.

Moreover, the use of tools like the Synthetic Data Vault enables organizations to generate synthetic datasets that simulate real-world patterns, which is essential for strengthening fraud detection. This strategy not only avoids the exposure of sensitive information but also enhances the models’ ability to recognize constantly metamorphosing fraudulent tactics. In turn, the SDV tackles the problem of data imbalance by increasing the representation of rare fraud cases.

Proper evaluation of models in a federated environment is paramount. Organizations must develop structured dataset strategies, utilizing diverse data combinations to ensure a fair evaluation of the models. This helps reduce bias and optimize fairness in measuring the performance of fraud detection tools.

Initial results from these methodologies have been promising, showing significant improvements in fraud detection accuracy. By training on varied datasets, the models can identify a broader range of patterns, which has, in turn, reduced false positives and increased detection effectiveness.

In summary, the use of the Flower framework in combination with Amazon SageMaker AI represents a robust and privacy-respecting approach to fraud detection. By integrating decentralized training, synthetic data generation, and fair evaluations, financial institutions are better equipped to enhance accuracy in fraud identification, all while adhering to current privacy regulations.

—

Let me know if you need any further assistance!

Source: MiMub in Spanish