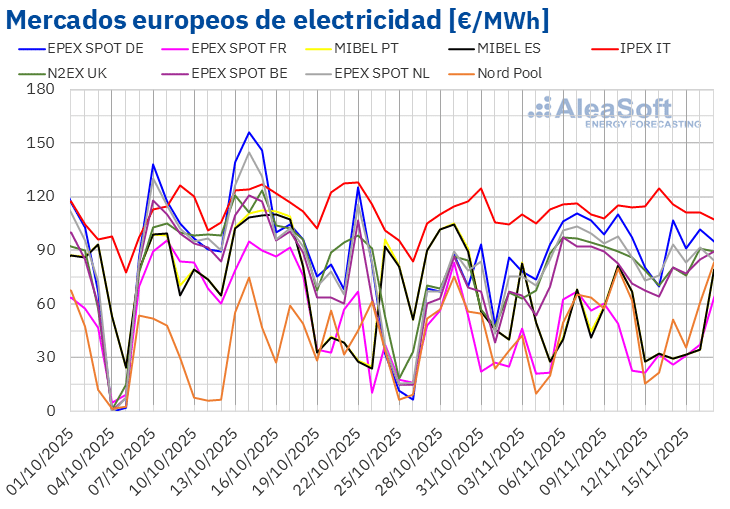

In the second week of November, electricity prices in most of the major European markets experienced a significant fall compared to the previous week. This decrease is mainly attributed to the increase in wind production and the low gas prices. On November 13, TTF gas futures closed at 30.46 €/MWh, the lowest figure since May 2024. Despite a decrease in photovoltaic solar production, overall electricity demand grew in most European markets.

During the week of November 10, solar production was significantly affected, with the Portuguese market experiencing the largest decrease at 45%. The Spanish, French, and German markets also saw significant drops of 21%, 18%, and 27% respectively. However, an increase in photovoltaic production is expected in Spain during the week of November 17, while decreases are anticipated in Italy and Germany.

On the other hand, wind production showed a notable increase in most markets. Portugal led with a 53% increase, followed by Spain with 17%. France and Germany also experienced growth of 29% and 40% respectively. Italy, on the other hand, reported an 18% decrease in its wind production, marking the third consecutive week of decline in this sector.

Electricity demand also increased in most European markets. Portugal saw the highest growth at 5.8%, while Germany had the smallest increase at 1.1%. Increases in Italy, Spain, and the United Kingdom were 2.2%, 2.9%, and 4.2% respectively. However, France and Belgium saw decreases of 1.8% and 6.6% respectively due to the holiday on November 11.

The average temperatures of the week were higher than the previous week in most markets, with Germany and France standing out with increases of 1.1 °C and 1.0 °C. This will affect forecasts for the third week of November, where a general increase in electricity demand is expected as temperatures drop.

In terms of electricity prices, most markets saw decreases, except for the IPEX market in Italy and Nord Pool in the Nordic countries, which increased by 3.8% and 6.1% respectively. The EPEX SPOT market in France experienced the largest percentage decrease with a 34% drop. Weekly average prices remained below 85 €/MWh in most markets, with the French market reaching the lowest average at 31.28 €/MWh.

Additionally, Brent oil prices showed fluctuations, starting with a high of $65.16/bbl on November 11, followed by a drop, but by the end of the week they recovered, closing at $64.39/bbl, representing a 1.2% increase compared to the previous week.

The abundant supply of natural gas, along with a decrease in demand in China, has helped to keep TTF gas prices at low levels. As for CO2 emission rights prices, they also showed variable trends, ending at 80.94 €/t towards the end of the week.

AleaSoft Energy Forecasting, which has been analyzing these trends, warns that electricity prices are expected to increase in most markets for the third week of November, driven by an increase in demand and a reduction in wind production in certain areas. In the Italian market, however, an increase in wind production is expected to contribute to a decrease in prices.

Source: MiMub in Spanish