In an increasingly digitized world, the handling and analysis of data has become a crucial source of competitive advantage for companies, including those in the financial sector. By using their vast volumes of data, companies can apply specific domain knowledge to generate actionable insights, a strategy that is redefining the financial services industry. This sector, deeply reliant on regulation and under zero-sum competitive pressures, is no exception in seeking competitive advantages through advanced data analytics.

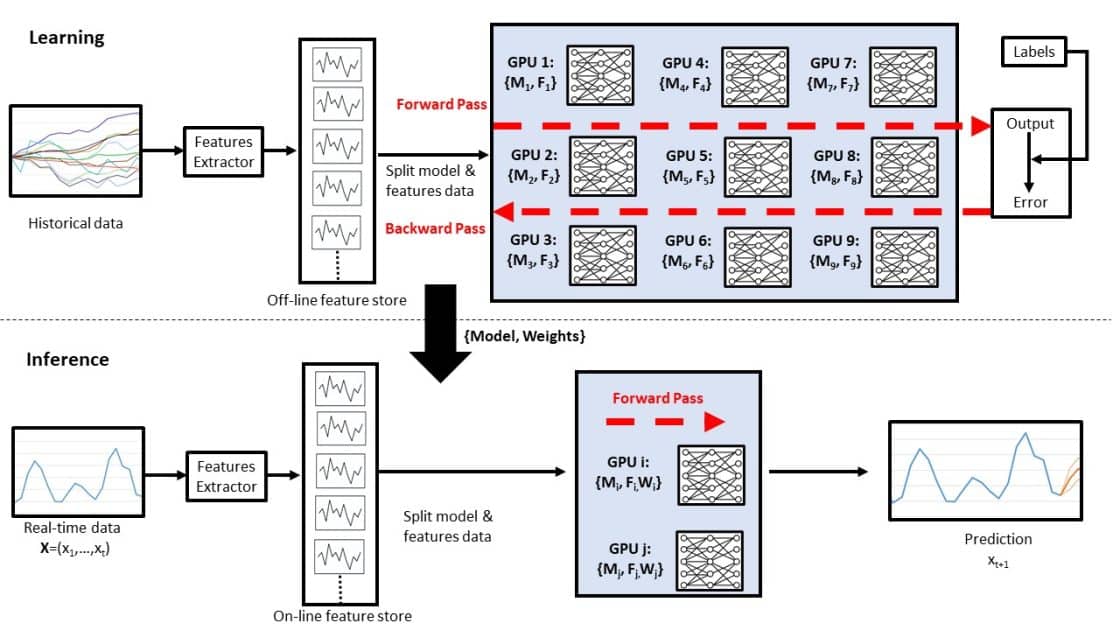

Accelerated computing, a term generally used to refer to specialized hardware known as purpose-built accelerators (PBAs), is enabling the financial services industry to accelerate a wide range of activities, from quantitative research to fraud prevention and real-time trading. This specialized hardware, including Graphics Processing Units (GPUs), plays a crucial role in both the learning and inference phases of the machine learning paradigm.

Within this context, financial sector executives, such as Chief Data Officers (CDOs), Chief Analytics Officers (CAOs), Chief Investment Officers (CIOs), and risk officers, are making strategic decisions about investments in infrastructure and competitive approaches. As they navigate a rapidly evolving field, understanding competitive differentiators and formulating an associated business strategy is essential.

Accelerated computing not only reduces the runtime of calculations, but also improves solution accuracy, customer experience, and provides a computational edge over competitors. In particular, deep learning has experienced a notable surge thanks to advancements in accelerated hardware, especially GPUs, which are crucial for training and inferring neural network models, as exemplified by their widespread use in transformer models for natural language processing.

The report provides a historical background on PBAs, from the commercialization of GPUs by NVIDIA in 1999 to their expansion into other applications beyond graphics and gaming. Meanwhile, large corporations are using hardware like AWS Inferentia and AWS Trainium to meet the demand for accelerated computing in ML.

The article highlights the crucial role of parallel computing in accelerating repetitive tasks and large volumes of data. Flynn’s taxonomy, which classifies computer architectures, provides a useful framework for understanding the operations of PBAs. For example, NVIDIA GPUs, with their multiple CUDA and Tensor cores, are designed to handle heavy workloads with dense numeric and data flow, paving the way for their use in AI and machine learning applications.

The use of accelerated EC2 instances on AWS, which offers a diverse range of options like F1 Xilinx FPGAs and P5 NVIDIA Hopper H100 GPUs, illustrates AWS’s ability to provide high-performance accelerated computing solutions. These options allow companies to select the optimal combination of hardware and services to accelerate their data and ML workflow.

Analytics and ML in the financial sector are evolving with notable examples of using GPUs and other PBAs in credit valuation adjustment (CVA) calculations, Monte Carlo simulation, and option pricing. Additionally, advanced applications such as chatbots and large language models (LLMs) are mentioned as revolutionizing the industry.

Regarding future strategies, the article emphasizes the need for business leaders to consider issues like proprietary software versus open source, tool complexity versus ease of use, as well as hiring and retention challenges. In summary, business leaders are encouraged to consult with AWS to explore how accelerated computing can benefit their organizations in the long term.

Referrer: MiMub in Spanish