Here’s the translation into American English:

—

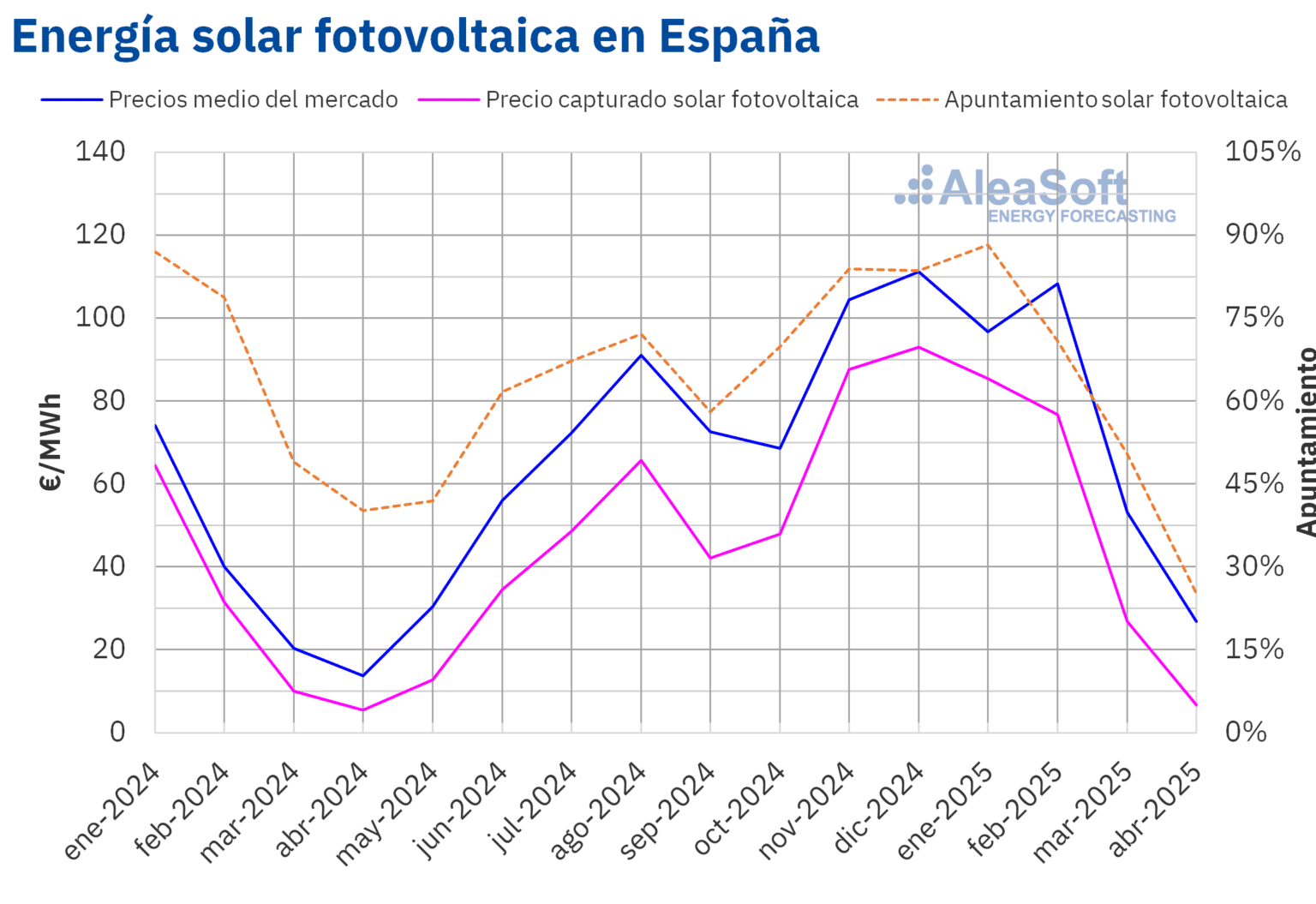

The photovoltaic energy sector in Europe is facing an unprecedented challenge due to the drastic drop in prices during peak solar generation hours. This phenomenon, known as price cannibalization, significantly affects the financial viability of numerous projects, making the adaptation to a new business model an urgent necessity. Between 9:00 AM and 5:00 PM, generation is so concentrated that supply exceeds demand, resulting in extremely low or even negative prices in critical situations.

Despite the accelerated growth of the sector in recent years, driven by reduced costs and a favorable regulatory framework, the current situation has called into question the profitability of photovoltaic projects. In some markets, the price captured for solar energy has been between 25% and 40% below the average market price, meaning the revenues generated are considerably lower than initial projections, which at times were overly optimistic.

In response to this risk, Power Purchase Agreements (PPAs) have emerged. However, buyers are currently more cautious, imposing increasingly stringent conditions. Prices in these contracts, when accessible, are often well below developers’ expectations.

Amid these challenges, the hybridization of photovoltaic systems with storage batteries presents a promising strategy. This integration not only allows for shifting generated energy to hours of higher demand, where better prices can be achieved, but also improves the project’s delivery profile, increasing its appeal to potential buyers in a PPA.

In addition to facilitating price arbitrage, the incorporation of batteries opens the door to new revenue opportunities such as ancillary services, participation in capacity markets, and reduction of penalties for deviations. With the ongoing reduction in battery costs and an increasingly favorable regulatory environment, it is expected that by the end of 2025, capacity auctions may arise that generate additional income for energy storage.

The current situation marks a turning point for the development of renewable energies. The traditional model of “generating and selling on the spot market” has ceased to be sustainable. Hybridization with batteries not only improves the profitability of projects, but will also play a crucial role in the imminent decarbonization process.

In this context, AleaSoft Energy Forecasting supports its clients in simulating more realistic revenue scenarios and assessing the profitability of these new hybridization initiatives. Additionally, the company has scheduled a webinar to discuss energy market prospects and the relevance of storage, featuring experts in the field.

—

If you need any adjustments or further assistance, let me know!

Source: MiMub in Spanish