The modern banking faces significant challenges, especially in the area of loan processing, where speed and security are crucial. In this context, Amazon Q Business emerges as an innovative solution that uses artificial intelligence to analyze regulatory requirements and loan granting patterns. This tool not only speeds up processes, but also optimizes fraud detection through a system of plugins that integrate with Amazon Connect, marking a radical shift in traditional loan operations.

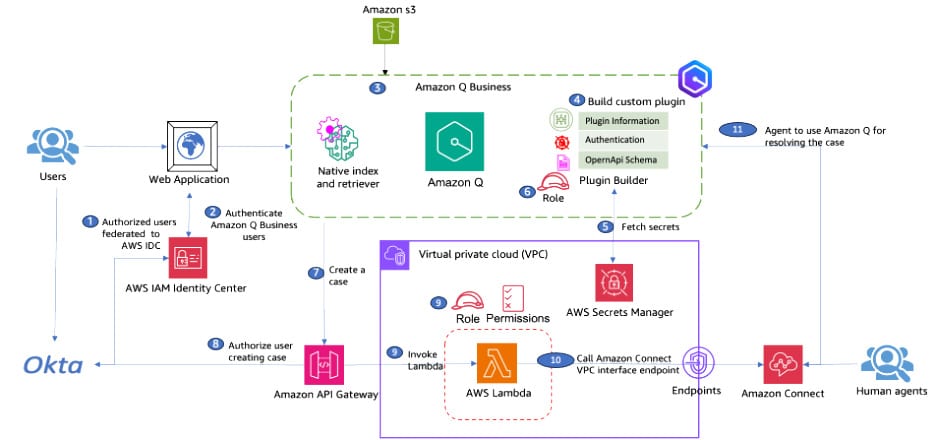

Amazon Q Business is presented as an AI-powered assistant capable of answering questions, summarizing information, and performing various tasks based on data stored in business systems. Its functionality is expanded through the inclusion of plugins that allow interaction with third-party applications such as Jira, ServiceNow, Salesforce, and PagerDuty. Administrators can activate more than 50 available actions in its library, and, if specific features are required, they have the option to develop custom plugins. This flexibility not only optimizes tasks but also enhances productivity by integrating different services into its interface.

On the other hand, Amazon Connect stands out as a crucial tool for contact centers, offering a unified experience and a comprehensive set of features across multiple communication channels. Its Amazon Connect Cases feature allows agents to manage customer issues that require multiple interactions, centralizing relevant information and facilitating more efficient case tracking.

Furthermore, this solution is complemented by the integration of the Okta identity management platform, which adds an extra layer of security through robust authentication and single sign-on (SSO) capabilities, essential for enterprise clients.

The combination of Amazon Q Business and Amazon Connect transforms the experience of loan approval officers, allowing them to work more smoothly and efficiently. Instead of switching between applications, they can conduct investigations and report potential fraud directly from the mortgage approval interface, improving operational efficiency and employee support.

As businesses adapt to a constantly evolving corporate environment, this integration of emerging technologies promises not only to revolutionize the banking sector but also to have a profound impact on various industries, enhancing collaboration and access to information to maximize business performance.

via: MiMub in Spanish