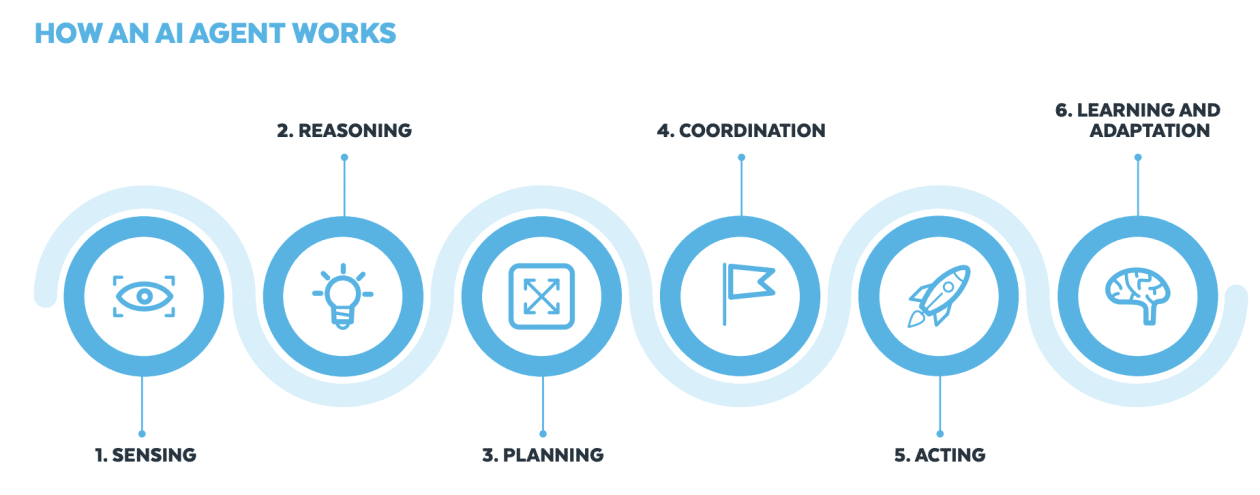

A new approach to process automation in the insurance industry is being driven by autonomous artificial intelligence, known as Agentic AI. This type of artificial intelligence combines traditional and generative capabilities to operate with minimal supervision, allowing organizations to carry out complex tasks more efficiently and effectively. In the realm of auto insurance claims, Agentic AI has shown its potential to simplify the complicated claims management process.

The presented solution includes a workflow that automates every stage of the claims processing, from document validation to informed decision-making. This helps reduce human errors, increase scalability, and improve operational efficiency. This solution is supported by tools from the Snowflake AI Data Cloud and Amazon Web Services (AWS), integrating various functionalities that enable organizations to make data-driven decisions, thus optimizing their competitiveness in the market.

One of the most prominent challenges in the insurance industry is the manual handling of document validation, such as driver’s licenses, claims forms, and damage photos. This traditional approach is not only labor-intensive but also rife with error possibilities. Implementing an Agentic AI workflow automates the entire process, ensuring that requests are processed more quickly and accurately.

The proposed workflow utilizes several key services. On one hand, Snowflake and its Document AI offer the ability to extract data from unstructured documents and convert them into structured data. On the other hand, Amazon Nova Lite enables analysis of vehicle images to identify and summarize any visible damage in a single interaction.

The process begins when the user uploads the necessary documents, including a driver’s license scan, a claim form, and a photo of the car damage. Once the data is received, it is processed using Document AI models that extract structured fields. Subsequently, image analysis is performed with the Nova Lite model to assess visible damage.

Additionally, comparisons are made between the extracted information and existing policy records in Snowflake, ensuring the validity of the claims. The results of this validation are used to make a decision on the claim, which is then communicated to the customer through an automatically generated email. This approach not only saves time and reduces costs but also establishes a standard of transparency and trust in claims processing.

Autonomous artificial intelligence represents a significant step towards modernizing services in the insurance industry, providing tools that enable more agile and environmentally dependent interactions. As these technologies continue to develop, a broader adoption is likely to be observed in various sectors, transforming the way organizations operate and interact with their customers.

via: MiMub in Spanish