Sure! Here’s the translation into American English:

—

The detection of financial fraud has become a priority not only for banks but for the entire global financial system, as annual losses exceed $40 billion. Financial institutions are facing an increasingly complicated threat landscape, with fraudulent schemes operating across multiple accounts and institutions, creating networks specifically designed to evade detection systems.

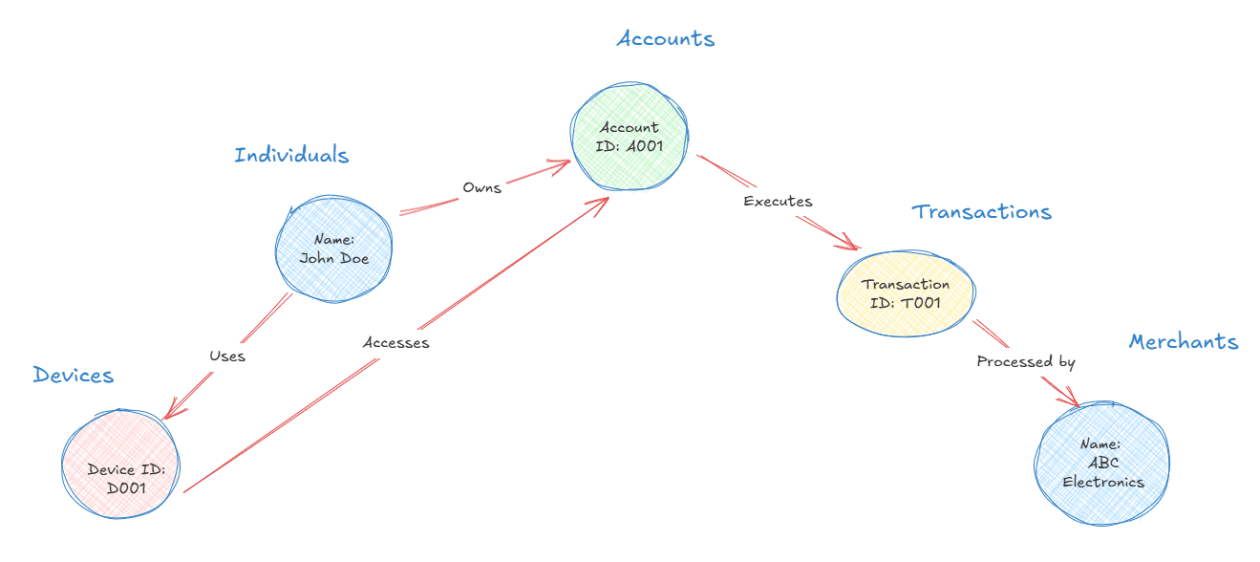

Despite significant investments in their detection capabilities, the main challenge lies in connecting the scattered information in a fragmented environment. Evidence of fraud is found in the relationships between documents and transactions, not in isolated elements, which further complicates effective detection.

An innovative approach is being implemented through the use of Amazon Bedrock’s Knowledge Bases, combined with GraphRAG. This development allows financial institutions to establish fraud detection systems without the need to build complex infrastructures from scratch. The managed service facilitates the construction and maintenance of knowledge graphs, integrating with foundational models that provide natural language understanding. Thanks to this technology, critical connections between entities are preserved, and existing data is leveraged, enabling analysts to perform natural language queries to identify suspicious patterns.

For example, a fictional bank in Australia seeking to detect fraudulent behaviors might use this approach to formulate simple queries like “What accounts does Michael Green own?” or more complex ones like “Which devices have accessed account A003?” Additionally, they can inquire about temporal patterns or unusual transactions, making it easier to identify relationships that may have otherwise gone unnoticed.

As fraud becomes increasingly sophisticated, tools like GraphRAG become essential for financial entities, allowing them to analyze and connect information effectively. The need for intelligent document processing aligns with the urgency to detect fraud quickly and accurately. In this sense, GraphRAG significantly enhances institutions’ ability to detect complex schemes that traditional methodologies might overlook.

As financial crime evolves, the integration of advanced solutions like GraphRAG represents a crucial advancement in the fight against fraud, equipping organizations with the necessary tools to adapt to and confront emerging challenges.

—

Source: MiMub in Spanish