Currently, stock technical analysis has become so complex that it requires highly sophisticated business logic. The combination of multiple technical indicators, such as the Simple Moving Average (SMA), the Exponential Moving Average (EMA), and the Relative Strength Index (RSI), among others, adds layers of complexity in programming algorithms capable of breaking down questions into relevant data.

In this context, artificial intelligence continues to open up new opportunities to gain a competitive advantage. Amazon, always at the forefront of technology, offers with its Amazon Bedrock service a set of generative AI models that promise to revolutionize the market, maintaining security and privacy as priorities. With Amazon Bedrock Agents, companies can perform complex tasks in multiple steps and enterprise data systems, thus answering questions, managing orders, and more.

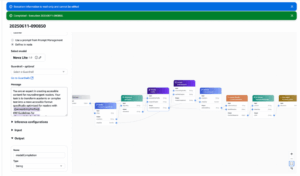

Recently, a virtual analyst has been implemented, capable of dynamically responding to queries in natural language about stocks that meet certain technical criteria, using Amazon Bedrock agents for this purpose. This model allows transforming simple or complex queries into specific interactions with Amazon’s Lambda service, obtaining the necessary and relevant technical information for the user. Stock data, previously stored in Amazon S3, facilitate real-time calculations and immediate responses to the consultant’s needs.

The process begins with a Lambda function, developed in Python, responsible for obtaining annual stock data using the yfinance package, data that is then stored in S3 through Amazon EventBridge. From there, an Amazon Bedrock agent processes the user’s questions, breaking them down and executing a plan that allows for the acquisition of precise technical data. Currently, this system is configured to analyze indexes such as the Nasdaq 100, FTSE 100, and Nifty 50, simplifying processes that previously involved complex IT management.

The execution of natural language queries allows users to obtain specific answers, such as identifying stocks whose value has increased by 10% in the last six months, using advanced technical analysis. With the support of this technology, Amazon Bedrock is setting a new standard in financial analysis by automating complex tasks, providing companies with resources that streamline their decision-making processes and improve their performance in the market.

Referrer: MiMub in Spanish