In the second week of January 2025, European electricity markets experienced variable behavior in energy prices, driven by various factors that have influenced production and demand. The decline in gas prices and an increase in wind energy generation contributed to a decrease in prices in some markets, while in others the situation was different, with increases due to the rise in electrical demand.

France made history by setting new records for solar photovoltaic and wind energy production for a January day. During the week of January 6th, several markets showed a notable increase in solar photovoltaic production, with increases of 33% in Germany and 16% in France. In contrast, the Iberian Peninsula experienced a reduction in production, with a 2.8% decrease in Spain and more pronounced decreases of 22% in Portugal and 24% in Italy. Remarkably, on January 12th, France and Portugal reached historic figures of solar production with 51 GWh and 12 GWh, respectively.

Wind production was also favored, especially in the Italian market, where the increase was 153%. France recorded its highest wind production in January with a total of 416 GWh. However, it is anticipated that wind production could decrease in the third week of January, according to AleaSoft Energy Forecasting forecasts.

Electric demand grew in all analyzed markets, with a 22% increase in the British market standing out, followed by increases of 18% in Italy and 15% in Germany. This increase in demand was accompanied by higher temperatures compared to the previous week.

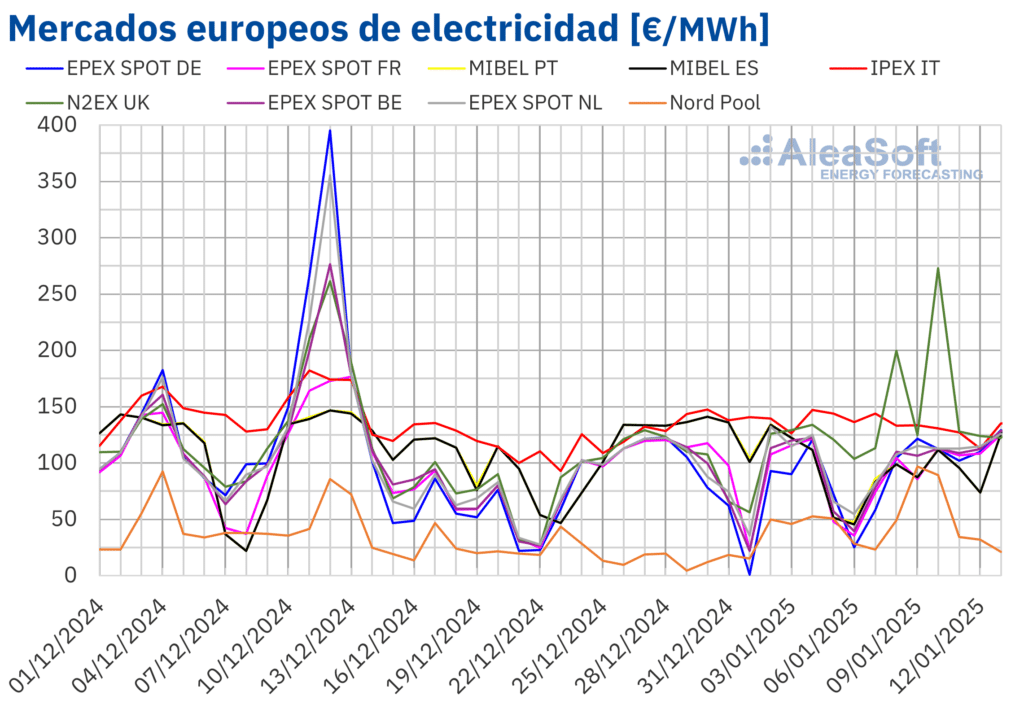

The average prices of the main electricity markets reflected this diversity. In the EPEX SPOT market in France and in the MIBEL markets in Spain and Portugal, as well as in the IPEX in Italy, prices decreased between 0.5% and 25%. However, other markets such as Nord Pool, which covers the Nordic countries, saw significant increases, with a 44% rise.

The British market reached the highest daily price of the week, at 272.43 €/MWh, the highest level since December 2022. These fluctuating prices were also influenced by the behavior of Brent oil futures, which experienced an increase, closing the week at 79.76 $/bbl on January 10th.

As for TTF gas futures, although they started the week with historic figures, they ended with a slight decrease. Despite this drop, a possible recovery is anticipated in the context of the conflict between Russia and Ukraine.

The European energy sector continues to face challenges and transformations in its energy matrix. The realization of webinars and specialized analyses, such as those from AleaSoft, offer a detailed insight into the trends and changes shaping the future of the energy sector in Europe.

Source: MiMub in Spanish