The Dubai Financial Market (DFM) and SIX, the Swiss group of financial market infrastructures, have announced today a collaboration agreement during the second edition of the Capital Market Summit. This alliance underscores the commitment of both entities to explore and implement initiatives that promote mutual growth and innovation in the global financial landscape. Under the umbrella of DFM, Dubai Central Securities Depository LLC (Dubai CSD) and Dubai Clear LLC are also part of the agreement.

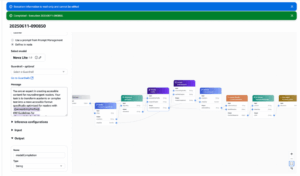

The collaboration focuses on assessing and implementing opportunities for dual listing or cross-listing of financial products. The agreement aims to simplify the process of transferring shares between exchanges for investors, facilitating cross-listings and share fungibility. The initiative is also expected to expand market access and strengthen investment prospects for participants in both regions and markets. In addition, SIX and Dubai CSD will partner to establish links between Central Securities Depositories (CSD) to facilitate share fungibility and cross-border transfers.

The agreement was signed during the Capital Market Summit, with the presence of Bjørn Sibbern, Global Head Exchanges and member of the SIX Management Committee, and Hamed Ali, CEO of DFM and Nasdaq Dubai.

Hamed Ali, CEO of DFM and Nasdaq Dubai, emphasized that “the strategic alliance between DFM and SIX exemplifies our shared commitment to driving innovation and fostering growth in the global financial landscape. Through collaborative initiatives, our goal is to unlock new opportunities, enhance market efficiency, and strengthen ties between our vibrant financial ecosystems.”

Meanwhile, Bjørn Sibbern, Global Head Exchanges and member of the SIX Management Committee, stated that “SIX – which already offers a highly international environment and is home to many multinational companies – continually strives to expand and enhance its range of international products and services. With the collaboration with Dubai Financial Markets, we are delighted to broaden companies’ options for raising capital and accessing additional and deep capital pools, as well as facilitating cross-border transfers and share fungibility.”

Both organizations will educate companies and issuers on the advantages of each market, providing access to growth opportunities and services. They will also collaborate in identifying opportunities in areas such as market data and post-trade services, striving to drive innovation and foster market development.

Referrer: MiMub in Spanish