In a recent report on the financial state of organizations in Europe, it has been revealed that 53% of Spanish companies have plans to expand internationally in the next two to three years. This data slightly surpasses the European average, which stands at 51%. However, despite the intentions of internationalization, companies in the country show a notable lack of confidence in critical aspects for this expansion, such as credit assessment and international payment management.

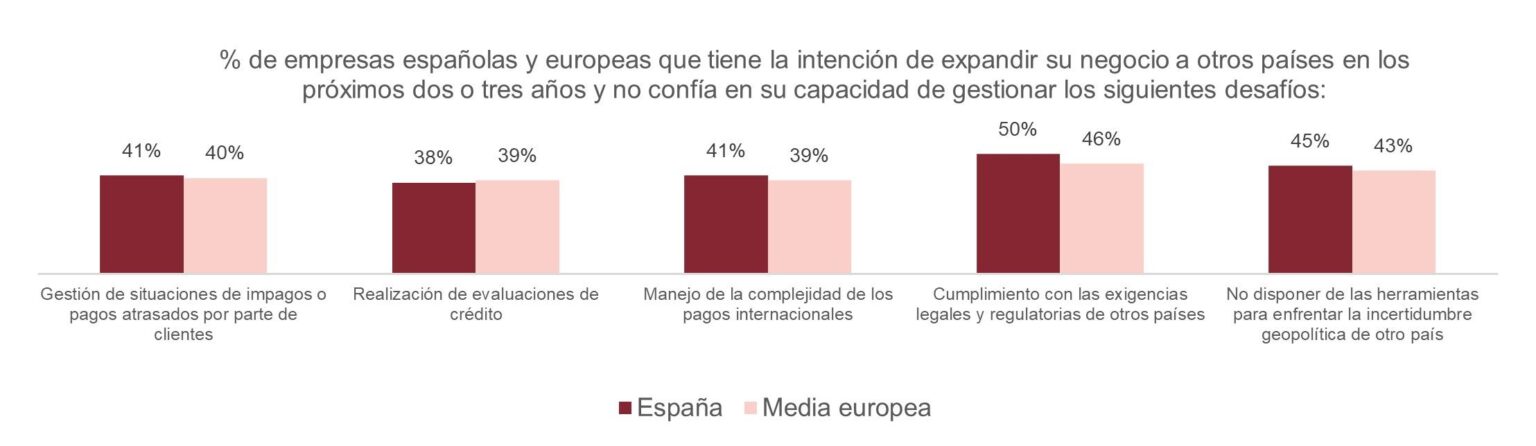

The study, conducted by Intrum, highlights that 41% of Spanish organizations planning to go abroad do not trust their ability to deal with situations of non-payment or late payments. This concern reflects a similar trend in the rest of Europe, where 40% of companies share this worry. Additionally, 38% of the surveyed entities in Spain acknowledge their inability to conduct credit assessments, an essential process to determine the solvency of customers and ensure secure transactions.

The complexity in payment handling, including currency conversion and the use of unfamiliar payment methods, presents another significant challenge. 41% of Spanish companies indicate their lack of confidence in managing these aspects, which is above the European average of 39%. Differences in regulations, deadlines, and payment platforms can increase uncertainty and jeopardize business liquidity, a crucial factor in internationalization.

Moreover, the report reveals that 50% of organizations in Spain feel uncertainty regarding compliance with legal and regulatory requirements in other countries, a percentage that is also higher than that recorded in Europe, where it stands at 46%. It is also highlighted that 45% of companies do not have the necessary tools to address geopolitical instability and other risks related to expansion, a figure that closely aligns with the 43% in Europe.

These data highlight the challenges faced by Spanish companies when trying to operate in an international environment, characterized by diverse regulations and legal systems. Debt management becomes essential to ensure the liquidity and financial stability of the business in this context. Therefore, having a trusted ally to help minimize the risk of non-payment and optimize financial management becomes essential to guarantee a successful and sustainable international expansion.

Referrer: MiMub in Spanish