Here’s the American English translation of the provided text:

—

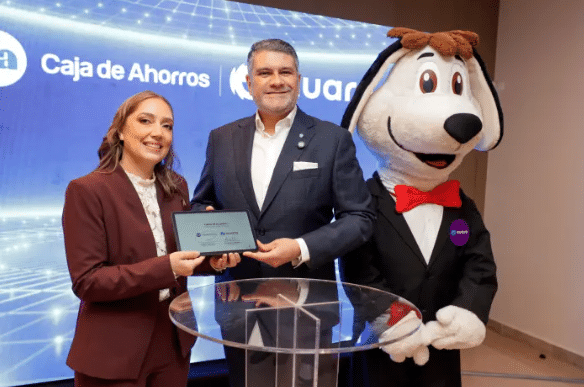

In a significant step towards modernizing the financial system in Panama, Caja de Ahorros has announced its official integration with Kuara, the national instant payment network. This advancement will enable more than 1.5 million users to make interbank transfers instantly, using only the recipient’s phone number. The initiative, presented by the bank’s general manager, Andrés Farrugia, aims to facilitate interoperability among different banks in the country.

The partnership between Caja de Ahorros and Kuara not only provides customers with the ability to send and receive money in real time but also strengthens financial connectivity in Panama. Farrugia stated that this integration marks a milestone in the bank’s digital transformation strategy, which focuses on providing innovative and accessible solutions for all citizens.

“This is a bold step towards the digital future we are building for Panama. The integration with Kuara not only enhances our customers’ experience but also positions Panamanian banking within the most advanced financial ecosystems in the world,” said Farrugia.

Kuara functions as a system that connects various financial institutions, eliminating the need to wait for transaction completions and simplifying the process with transfers that require only a cellphone number. The platform utilizes certified infrastructure that ensures both security and transparency in every operation, helping to create a more reliable financial environment.

Users will be able to access this functionality through the Mobile Banking app and Online Caja, without needing to download new applications or link additional accounts. The system will operate continuously, even on weekends and holidays, promoting efficiency among individuals and in commerce.

This integration not only represents an advancement in the convenience and speed of transactions but also boosts the digital economy in Panama, expanding the coverage of instant payments to more than a third of the population. It is expected to strengthen the country’s formal and traceable economy, reducing reliance on cash and improving the circulation of money in a safer and more transparent environment.

Referrer: MiMub in Spanish