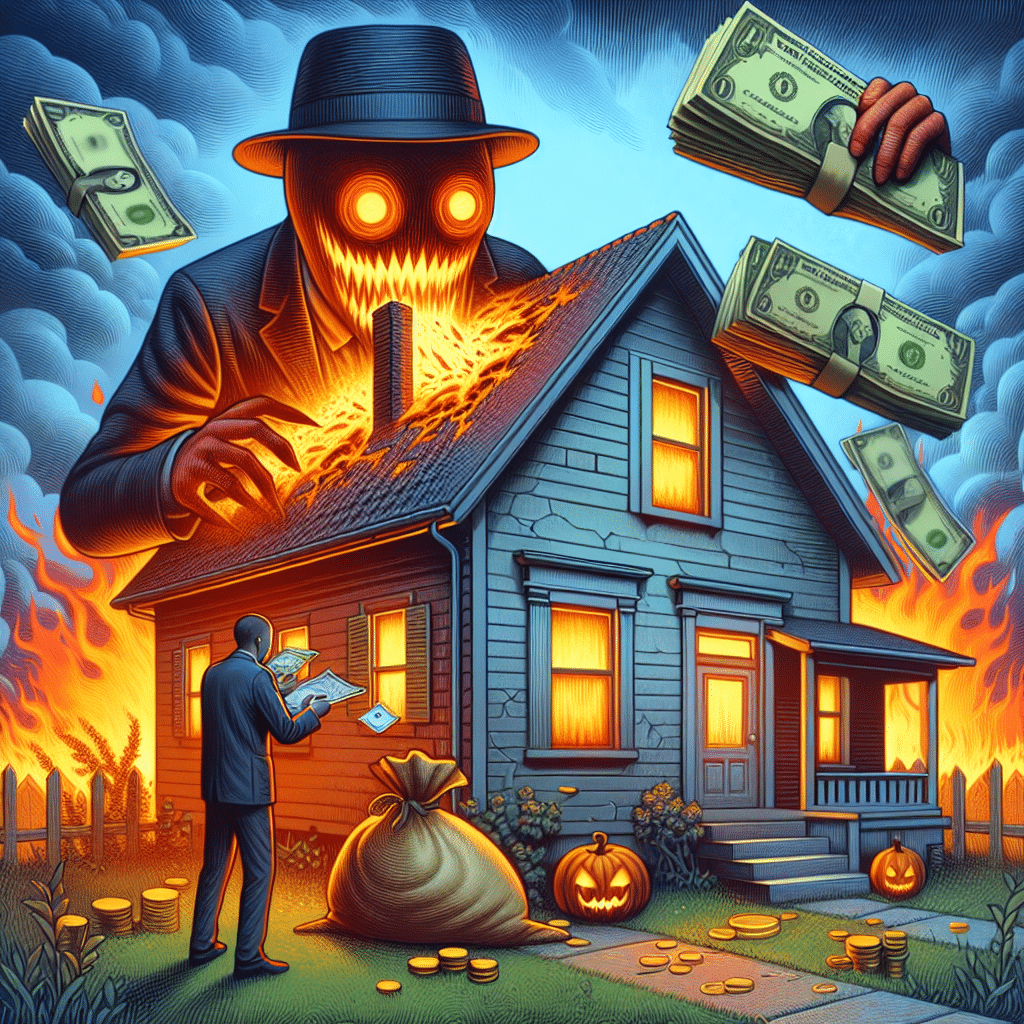

When it comes to buying a home, many people make a financial mistake that can have significant long-term consequences, and the most alarming thing is that most of them are not even aware of it. This phenomenon is due to a combination of emotional factors, lack of information, and a limited understanding of the real estate market.

One of the most common mistakes is underestimating all the costs associated with purchasing a house. Many buyers focus solely on the property’s price, ignoring additional expenses like taxes, insurance, maintenance, and financing costs. This narrow view can lead to unexpected situations that affect their personal finances and the long-term viability of their investment.

Another important issue is the lack of research about the neighborhood. Some buyers choose a home simply because they like its design or yard, without considering crucial aspects like the quality of schools, the safety of the area, and access to basic services. Buying in an area with growth prospects can turn out to be a more solid financial decision.

Social pressure also plays a fundamental role in this process. Many people feel the need to buy a home as a symbol of stability and success. This pressure can lead to impulsive decisions, where some purchase properties that are beyond their financial means just to meet those expectations. This trend results in accumulating debt and a financial burden that is difficult to manage.

Financial experts emphasize the importance of planning. A proper assessment of one’s personal economic situation and the creation of a clear budget are essential to avoid surprises. Consulting professionals in the field, such as real estate or financial advisors, is also recommended, as they can provide a clearer perspective on the buying process and help identify potential risks involved.

Financial education is crucial in this context. Understanding the different elements involved in buying a home prepares buyers to make more informed decisions, while also allowing them to build a solid and sustainable wealth over time. Knowledge is power, and in the realm of finance, this statement has never been more relevant. Next time you consider buying a home, it’s essential to reflect on these aspects and ensure you are making the best decision possible for your economic future.

Source: MiMub in Spanish