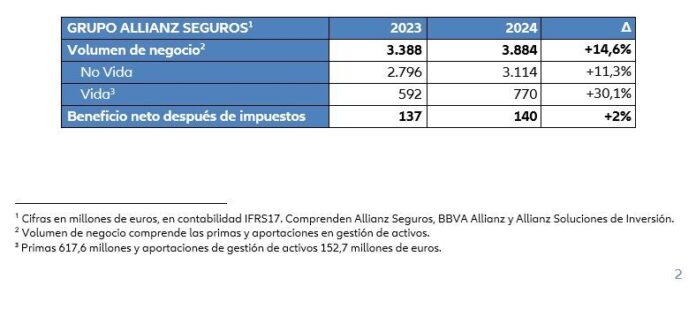

The Allianz Insurance Group in Spain has closed the year 2024 with very positive results, showing notable growth in all its business segments. The total business volume has increased by 14.6 percent, approaching 4 billion euros. This momentum has been led by double-digit growth in Non-Life premiums, which have experienced an 11.3 percent increase. Additionally, the Life and Asset Management area has stood out with an impressive growth of 30.1 percent, demonstrating the increasing consumer interest in savings and investment products.

Allianz Seguros’ net profit after taxes has reached 140 million euros, representing a 2 percent increase compared to the previous year. This solid financial performance is attributed to the trust of its more than 4.5 million clients, as well as the effort of its agents and brokers, and the support of its banking insurance partners.

The company has emphasized its commitment to excellence in service and customer loyalty. Recently, it has been recognized as one of the best companies to work for, ranking 17th on the list of the 25 best companies in the world according to the World’s Best Workplaces 2024™ ranking. This recognition reflects its focus on employee well-being, resulting in over 123,000 hours of training and flexible work policies, allowing more than 50 percent of its staff to work remotely.

Regarding customer service, Allianz has handled 1.4 million claims in the last year, demonstrating its operational capacity. In a show of commitment during emergency situations, the company proactively intervened during the recent Levante DANA, managing over 11,600 claims and sending 57,000 alert messages to at-risk customers.

The use of technology has been essential to improve the efficiency of its services. In this regard, 212,000 digital assessments were conducted that not only streamlined customers’ lives but also helped reduce unnecessary travel. In this line, Allianz has achieved a significant reduction in its carbon footprint, avoiding the emission of 146.6 tons of CO₂ in its operations.

Looking towards the future, Allianz has expressed its intention to continue accelerating profitable growth and improving the customer experience. The company is steadfast in its goal of consolidating its image as the leading insurer globally, combining a human approach with the effective use of technology and data, preparing it to face market challenges and remain a benchmark in the insurance sector.

Source: MiMub in Spanish