In a context of increasing volatility in global financial markets, the latest monthly balance of SIX markets has revealed a series of significant developments that are capturing the attention of investors and analysts alike.

During the past month, major indices experienced notable fluctuations. Although the overall trend has been upwards, certain days were characterized by sharp drops that reflected economic uncertainty and prevailing geopolitical tensions in various territories. A rebound in technology and healthcare stocks significantly contributed to the recovery of temporary losses.

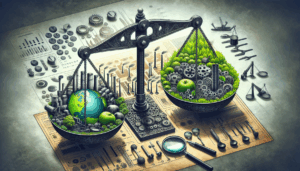

Volatility has been exacerbated by the evolution of monetary policies at the international level, with central banks adopting divergent positions on interest rates and economic stimulus programs. This environment has generated abrupt variations in capital flows towards emerging and developed markets, increasing uncertainty about short-term financial stability.

On the other hand, the bond market also showed signs of instability. Expectations regarding possible increases in benchmark interest rates led to a tightening of credit conditions, resulting in a decline in demand for long-term debt securities and a greater preference for liquid and lower risk assets.

Commodities were not left behind. Oil prices fluctuated due to various reasons, including expectations of global demand recovery and production adjustments by major exporting countries. In contrast, the precious metals market, such as gold and silver, showed a more stable trend, acting as a safe haven in times of economic uncertainty.

Additionally, the monthly report highlighted the central role played by blockchain technology and cryptocurrencies in the markets. Although this sector faced several days of high volatility and speculation, it continues to attract a considerable number of investors interested in diversifying their portfolios and betting on digital assets.

Overall, the monthly balance of SIX markets underscores the importance of maintaining a long-term view and a well-founded investment strategy in a period characterized by volatility and uncertainty. Investors and portfolio managers remain vigilant to economic and political developments that may influence future trends and are adjusting their strategies accordingly, trying to minimize risks and maximize opportunities in an increasingly complex financial environment.

via: MiMub in Spanish