Sure! Here’s the translation to American English:

—

In the competitive financial services sector, analysts are facing the growing complexity of managing various types of data. These include structured data, such as stock quotes over time; unstructured data, like regulatory reports and trend analyses; and audiovisual content, which encompasses earnings calls and presentations. This variety of formats requires special tools and differentiated analytical approaches, which can create inefficiencies in workflow. Furthermore, the pressure to make quick decisions intensifies, as any delay in analysis could result in significant losses or the inability to identify emerging risks.

Artificial intelligence (AI)-based solutions are proving crucial for improving productivity by automating the collection and analysis of routine data. However, using a single AI agent for complex investment research workflows may be insufficient. Collaboration among multiple AI agents represents a promising solution. This methodology involves creating specialized sub-agents that operate under a coordinated framework supervised by a main agent. This supervising agent can break down complex requests, delegate specific tasks to the sub-agents, and synthesize their responses comprehensively, replicating the dynamics of a human research team.

One of the platforms that facilitates this collaboration is Amazon Bedrock, which combines foundational models and APIs to effectively manage complex tasks. Thanks to the multipolar capability of its agents, it is possible to build and manage multiple AI assistants that collaborate on critical financial analysis tasks. This includes processing information from various modalities, such as documentation and audiovisual content.

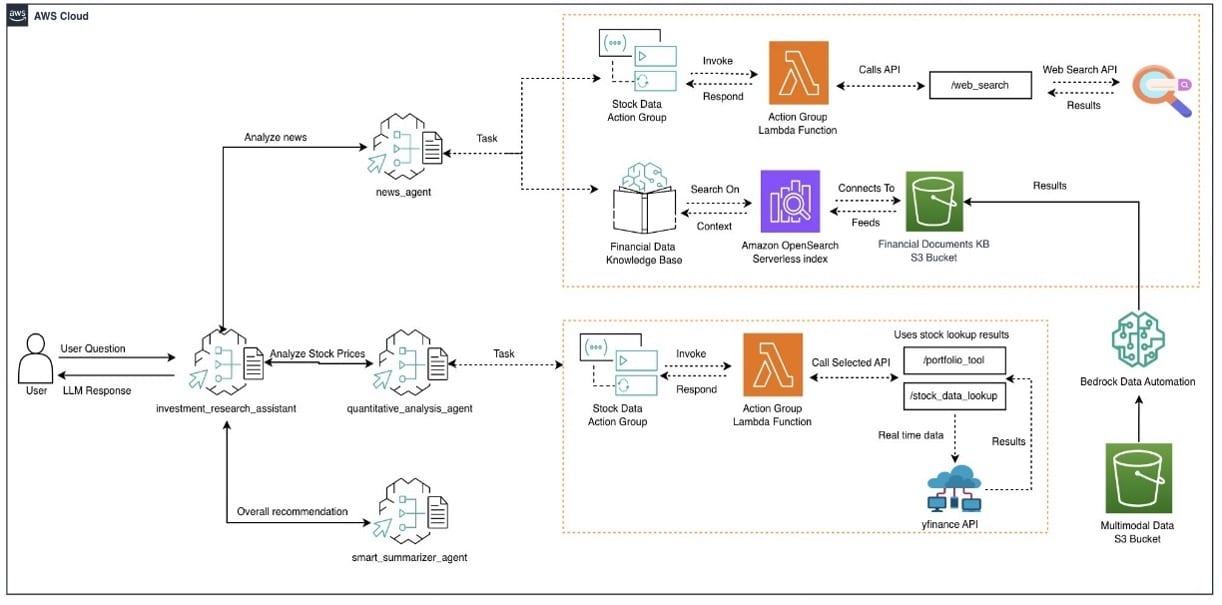

An innovative example of this strategy is an investment research assistant that integrates a supervising agent and three sub-agents: one focused on quantitative analysis, another on gathering financial news, and a third on information synthesis. Together, they work in a coordinated environment, allowing for the analysis of relevant news, assessment of stock performance, and optimization of portfolio allocation through a unified, natural language-based interface.

The technical structure behind this system allows for efficient management of these sub-agents. For instance, the quantitative analysis agent is responsible for processing historical stock information, while the news agent is dedicated to tracking relevant financial information. Meanwhile, the smart summarization agent compiles information from the other sub-agents to generate structured investment insights.

The process begins with a user request, which is broken down by the supervising agent into subtasks handled by the sub-agents, whose information is integrated at the end using a language model to provide final insights. This structure not only improves the quality and accuracy of the analysis but also provides a scalable framework that can adapt to the changing needs of analysts.

The integration of this solution through Amazon Web Services (AWS) reflects the potential of AI to transform workflows in financial analysis. This approach promises to empower industry professionals to manage workflows that previously would have been overwhelming for a single agent. With the advancement of collaboration among multiple agents, a more efficient future in risk assessment and regulatory compliance in an increasingly complex financial environment is on the horizon.

—

via: MiMub in Spanish