Sure! Here’s the translation of the text into American English:

—

Financial regulation presents constantly evolving challenges, leading to the need for more efficient tools for compliance reporting. In this context, Amazon Web Services (AWS) generative artificial intelligence solutions are revolutionizing how financial institutions approach this process. These innovations not only increase efficiency but also foster greater trust in the sector by ensuring the accuracy and timeliness of critical report delivery.

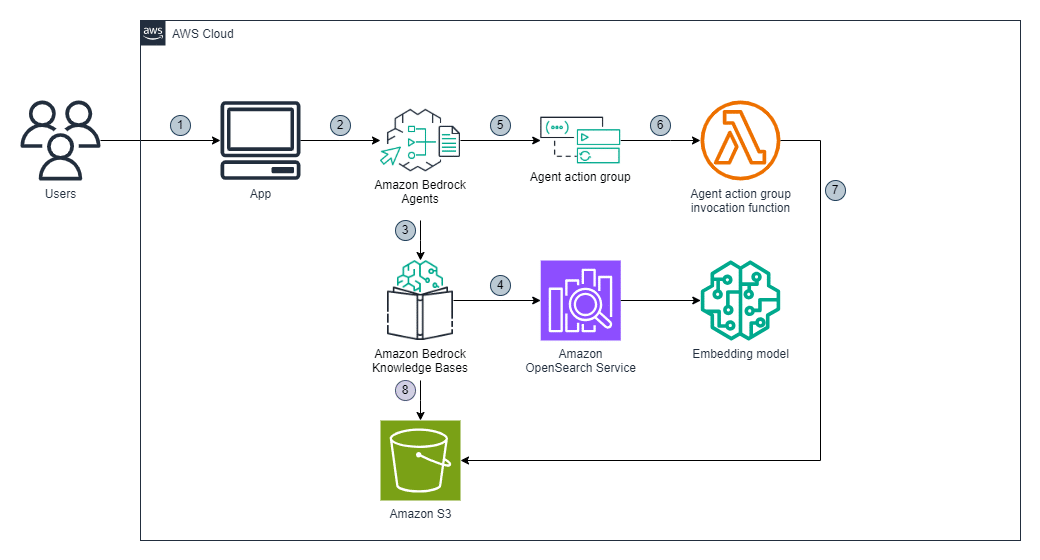

Amazon Bedrock stands out as a key service in this transformation. By providing access to advanced generative AI models, it enables businesses to create applications tailored to their needs, all with an emphasis on privacy and security. One of its standout features is the “Retrieval-Augmented Generation” (RAG) technique, which utilizes vector databases like Amazon OpenSearch to enhance the semantic search for relevant and contextual information.

Another essential component is Amazon’s Knowledge Bases, which, along with OpenSearch Serverless, enrich the model’s inputs with factual data, thus reducing the margin for error and increasing result accuracy. Additionally, Amazon Bedrock Agents facilitate the execution of multiple tasks through natural conversational flows, allowing applications to interact more effectively and engagingly with users.

One of the most important documents for the financial industry is Suspicious Transaction Reports (STRs), which must be submitted to regulators when there are signs of unusual activity. Traditionally, preparing these reports required a cumbersome and detailed manual process. However, the solution proposed through Amazon Bedrock allows for the automation of STR draft generation based on information about specific accounts and transactions, as well as correspondence summaries.

The workflow begins when a user requests the creation of a report through a business application. From this request, Amazon Bedrock Agents gather the necessary information through conversational dialogue, filling in any missing data. If information about fraudulent entities is needed, real-time semantic queries are conducted. If the required information cannot be found, the agent may ask the user to provide a link where the necessary data can be obtained, triggering an automated scraping process.

This advancement is considered a fundamental pillar in the regulatory compliance landscape, as it allows institutions to be more agile and less prone to errors that could harm their reputation or stability. The convergence between artificial intelligence and financial compliance is thus being redefined, emerging as a vital solution to the challenges institutions face in an increasingly complex regulatory environment.

—

If you need any adjustments or further assistance, feel free to ask!

Referrer: MiMub in Spanish