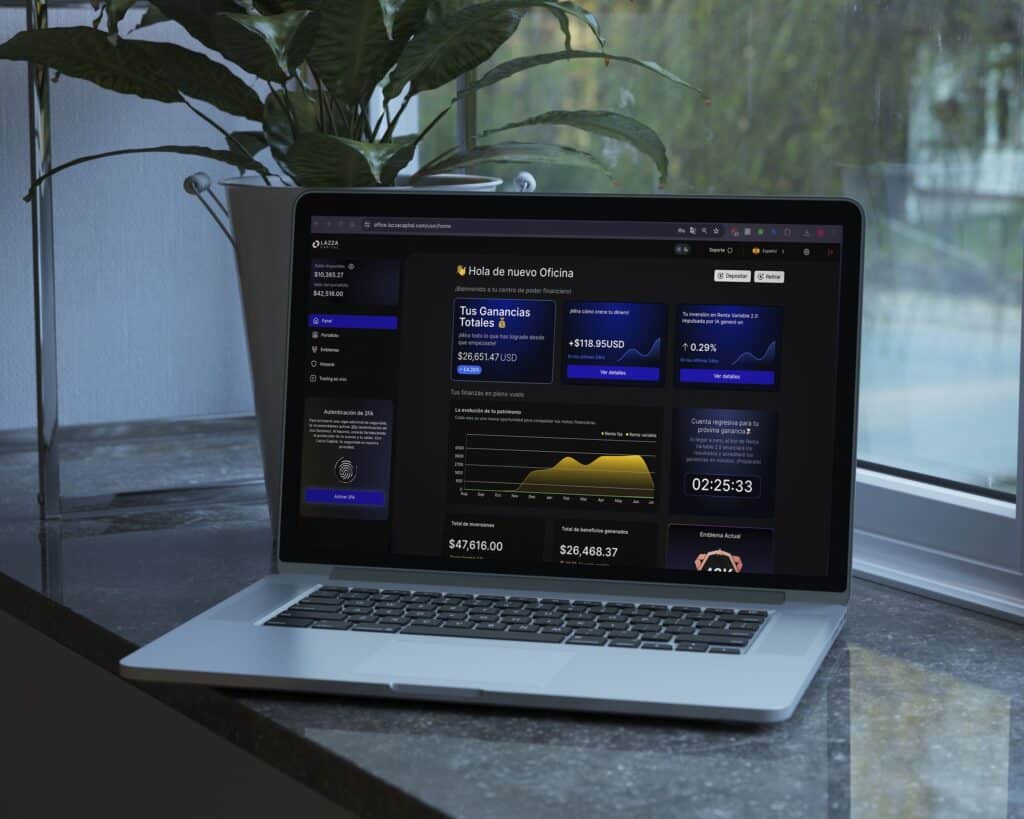

In a bold move that could redefine the landscape of digital investments, Lazza Capital launched BackOffice 2.0 on June 30th, a investment management platform that promises to take the investor experience to the next level. What stands out about this launch is not only the platform itself, but the seamless migration that took place without any interruptions for users, a noteworthy technical achievement in the volatile world of fintech.

This launch marks a turning point for the fintech firm, which has been rapidly gaining ground in a market dominated by established giants. BackOffice 2.0 is not just a simple upgrade, but a complete reinvention of how investors interact with their portfolios.

“The sector is on the cusp of a revolution in investment management,” says Yovani Escobar Quintero, CEO of Lazza Capital. “BackOffice 2.0 not only enhances the user experience, it completely transforms it.”

The platform incorporates a range of innovative features, including an intuitive interface with day/night mode, military-grade multifactor authentication, and a processing engine that promises to execute transactions in milliseconds. Perhaps most intriguing is the integration of blockchain technology, a move that could set new transparency standards in the industry.

But Lazza Capital doesn’t stop there. The company is already preparing the integration of live trading and demo money within this ecosystem, a move that could propel it to the forefront of innovation in the sector. These upcoming features promise to further democratize access to trading tools, traditionally reserved for institutional investors.

However, Lazza Capital’s true differentiator could be its focus on accessibility. In a sector often criticized for its complexity, BackOffice 2.0 seems to be designed with inclusivity in mind, with features that make the platform usable for investors of all experience levels.

This launch comes at a critical moment for the fintech sector. With the increasing adoption of digital financial services, the competition for investor attention has never been fiercer. Lazza Capital’s bet is that a superior user experience, combined with cutting-edge investment tools, can be the deciding factor.

While industry titans may have deeper resources, Lazza Capital is betting on agility and continuous innovation. BackOffice 2.0, along with the upcoming live trading and demo money integrations, is a statement of intent: this firm is not only here to compete, but to lead the next wave of fintech innovation.

It remains to be seen if BackOffice 2.0 and future updates will live up to Lazza Capital’s ambitious promises. However, one thing is clear: the bar for digital investment platforms has just been significantly raised. Lazza Capital’s competitors would do well to take note, as it seems they are facing a company determined to drive technological development in the financial sector.

Source: MiMub in Spanish